In this scenario, the total charges are

for an office visit and an x-ray. The primary insurance paid a portion of the

office visit and the x-ray charge. The EOMB indicated adjustments for exceeding

the fee schedule maximum allowable. The remainder is the patient

responsibility.

Example:

|

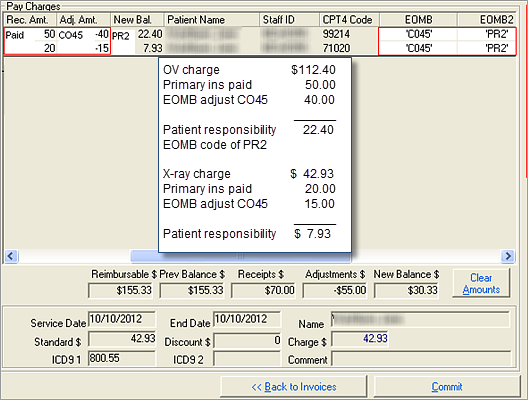

Office Visit:

- Total OV charge: $112.40

- Primary insurance paid: $50.00

- Adjustment: EOMB CO45 - Charge

Exceeds Fee Schedule Maximum Allowable by $40.00

- Patient responsible for balance

$22.40

|

X-ray:

- Total x-ray charge: $42.93

- Primary insurance paid: $20.00

- Adjustment: EOMB CO45 - Charge

Exceeds Fee Schedule Maximum Allowable by $15.00

- Patient responsible for balance

$7.93

|

The steps below presume that

SYSTOC and

SYSTOC_EDI settings are correct before

EOMB codes are applied. It is also presumed that the primary and secondary

insurance information and the relationship to the subscriber have been

documented, as well as the relationship to the patient if there is an alternate

subscriber.

-

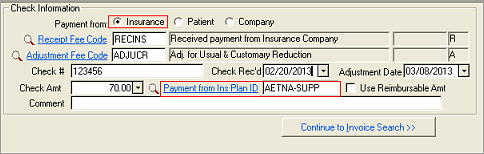

Navigate to

.

-

Click the

Insurance

radio button. Browse and select the appropriate insurance plan from the Payment

from Ins Plan ID lookup.

-

Click

Continue to Invoice

Search.

The Search for

Invoices screen displays. Search for the correct invoice using the normal

SYSTOC procedure.

-

Click

Next to Pay

Charges.

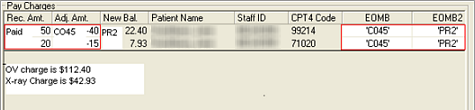

The Pay Charges

screen displays.

-

Apply the payments and adjustments.

-

Scroll to the right on the Pay

Charges screen to see the EOMB fields.

-

Enter the EOMB codes for each line

item.

-

EOMB: Enter the code for the

adjustment or denial.

-

EOMB2: Enter the code for the

person or entity responsible for the remaining balance.

The table below describes

using the two EOMB fields depending on the balance remaining to be paid:

| Line Item has...

|

EOMB Field

|

EOMB2 Field

|

| Remaining

balance after payment and adjustment.

|

Enter the

adjustment or denial reason code.

|

Enter the

appropriate code for person or entity responsible for remaining balance.

|

| Zero balance

after payment and adjustment.

|

Enter the

adjustment or denial reason code.

|

Leave blank.

|

| Zero balance

after payment.

|

Leave blank.

|

Leave blank.

|

The payment, adjustment,

and remaining balance for each line item must equal the total line item charge.

The claim will be rejected if payments and adjustments do not equal the total

charge on the 837 claim file.

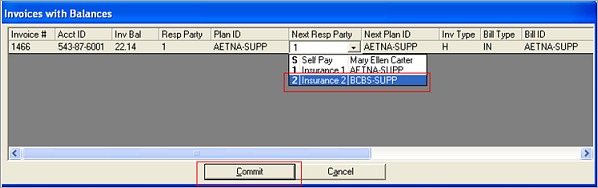

-

Click

Commit.

The Invoices

with Balances screen displays.

-

Select the next responsible party

from the drop-down list.

-

Click

Commit to

complete the data entry.

The claim

transmits to the secondary payer when processed.