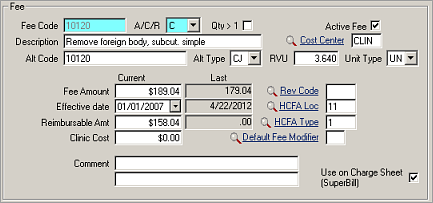

Fees

Use this screen to create a code for every service or item you sell, as well as adjustments and receipts. Standard charge codes may be set for different amounts per location. When you view a record, the individual fee that you see on the left side of the screen is the standard fee that applies to the base location. The fees in the grid on the right side, if any, are the location-specific versions of that fee.

You may wish to use CPT4 codes for your fees, unless you have a reason not to (for example, if your parent institution uses some other system). The CPT4 codes do not cover every situation, of course, and you will need to devise logical codes for screening services and receipts.

Remember you should not have blank spaces in any ID code. Dashes may be used if you have a need for prefix groupings. Decide whether you do or do not want dashes in codes that use a prefix, and be consistent.

Once the fee code system is in place, get a Charge Sheet printed, or use the Charge Sheet report that comes with SYSTOC. Group the fees by Cost Center when printing the report.

| Label | Description |

|---|---|

|

Fee Code |

Eight character ID code, use CPT4 code if possible. |

|

A/C/R |

Adjustment, Charge or Receipt. |

|

Qty >1 |

Check if this item/service might be used in quantities greater than one (per patient visit). |

|

Active Fee |

Indicates the status. When the box is checked, the status is Active. On an add record, this is checked by default. This is especially useful when excluding inactive Fees in search lists and reports. The search defaults to show active fees. |

|

Cost Center |

Department/cost center, see Cost Centers. |

|

Description |

Describe the fee, receipt or adjustment, prints on the invoice. |

|

Alt Code |

Alternate coding system such as CPT, HCPCS or ND. The Alt Code may be identical to the Fee Code . This code appears on the 1500 Claim Form and UB, and is required for fees that might appear on those invoices. |

|

Alt Type |

Defines the type of alternate code in the Alt Code field. Use CJ for a CPT code; HC for a HCPCS code; and ND for a National Drug Code. If you use ND , the 1500 Claim Form box 24d will print NDC# as the prefix to the Alt Code. |

|

RVU |

Relative Value Unit, useful for statistical analysis of workload. |

|

Unit Type |

Select from MN (minutes), DA (days) HR (hours) or UN (units) to describe the way this RVU is normally specified. |

|

Fee Amount |

Usual charge for this service. Normally left blank for Receipt and Adjustment codes. If you modify the Current amount of a fee, the old fee will automatically be recorded in the Last column when you save the data. |

|

Effective Date |

Date this fee amount was established. The change in a fee occurs as soon as you modify the amount, therefore the effective date should be today unless you are entering startup data. |

|

Reimbursable Amt |

For most uses, the dollar amount you expect to receive, before discounts. For TPAs, the amount you will owe the service provider. See Set up Reimbursable Amounts. |

|

Clinic Cost |

Optionally enter the cost of providing this service. |

|

Rev Code |

Revenue code for UB billing, see Revenue Codes. |

|

HCFA Loc / Type |

Location of Service code and Type of Service code for 1500 Claim Form, see HCFA 1500 Type/Place Codes. |

|

Comment |

Any additional information. |

|

Default Fee Modifier |

CPT4 fee modifier. During invoicing, when a fee code with a default modifier is used, the Modifier field on the Tracking Charge, Line Item Standard, or Charges to be Added screen fills automatically. |

|

Use on Charge Sheet |

Check to include this fee on the Superbill of commonly-used charges. The Charge Sheet report can be printed from SYSTOC, and will include only those charges that have a check mark in this field. |