Refunds

If a customer overpays an invoice, you will typically enter the overpayment and subsequently refund the money. This topic explains how to enter refunds in SYSTOC.

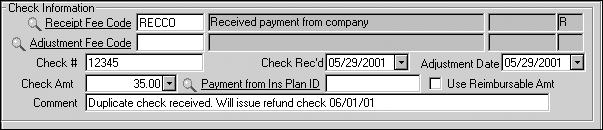

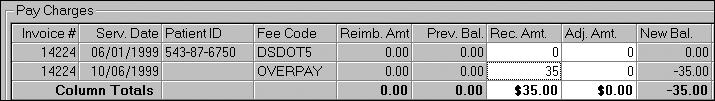

All receipts must be applied to line item charges; to accurately enter the extra money you must first enter a pseudo-charge. From the screen, retrieve the invoice that was overpaid (and write down the invoice number for later use). Then go to the Charge Detail level and select Add. You will receive warning messages designed to prevent entering new charges to a processed invoice. Add a new charge with a fee code of OVERPAY (create this fee code if it doesn’t exist). Use today’s date as the Service Date, and 0 as the amount. Save it. Adding this record will automatically change the Invoice Status to R (Rebill) from the P or Z status that it probably had before you began.

Click Continue to Invoice Search, select the invoice by invoice number, then Next to Pay Charges. On the Pay Charges screen, manually enter the amount of overpayment in the Rec Amt field, on the line which has the OVERPAY fee code (and remove it from the first detail line if the program automatically places it there). If you provided an ADJ fee code, the program will also make the adjustment. If you did not, the Adjustment column will be 0 and the invoice balance will become negative, which it will remain until you cut a refund check and enter an adjustment in the same manner. You can review your entry by going to the Summary screen for this invoice.

Although this method is obviously more labor-intensive than simply applying the extra money to some randomly-chosen line of the original invoice, it offers the following advantages:

- Any report that shows revenue for a particular fee code or cost center will be accurate even if the refund check has not been sent yet.

- When the refund check is entered, it will be easy to tell what line to apply it to (the OVERPAY line gets the adjusting refund); otherwise it might be difficult to tell, in a complex invoice, to which line the overpayment was applied.